How Market Insights Influence Investment Strategies

The world changes really fast now. Smart investors win because they use good, fresh market news to make better plans.

Big funds, pension money, rich-family helpers, and advisers all need fast and true facts. These facts help them:

- Put money in the right places

- Stay safe when things go bad

- Catch big wins that last many years

This article uses super easy words to show why deep market study is so important — and how the top companies turn facts into real money.

Why Professional Investors Can’t Ignore Market Insights

Large portfolios do not run on autopilot. A pension fund with billions under management or a wealth manager advising ultra-high-net-worth families must constantly adjust to new realities:

- Shifting interest rates

- Geopolitical tensions

- Inflation surprises

- Climate-related risks

- Rapid technology changes

These are not small ripples; they are waves that can reshape entire asset classes. This is why smart market news is the heart of big investor work today.

Big companies like Schroders, IFM, and Allspring do not just give old, simple funds. They use fresh facts to make active plans for:

- normal stocks

- private companies

- big buildings

- bonds

That helps their clients win more. Schroders – What We Do and Active Management Advantage1

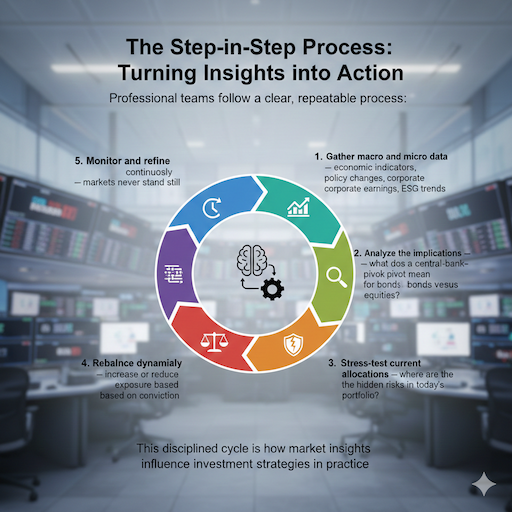

The Step-by-Step Process: Turning Insights into Action

Professional teams follow a clear, repeatable process:

- Gather macro and micro data — economic indicators, policy changes, corporate earnings, ESG trends

- Analyze the implications — what does a central-bank pivot mean for bonds versus equities?

- Stress-test current allocations — where are the hidden risks in today’s portfolio?

- Rebalance dynamically — increase or reduce exposure based on conviction

- Monitor and refine continuously — markets never stand still

This disciplined cycle is how market insights influence investment strategies in practice.

Key Areas Where Insights Drive Real Change

1. Interest Rates and Fixed-Income Positioning

When central banks signal rate cuts, professional investors move fast. They extend duration, favor investment-grade credit, or add inflation-linked bonds. Allspring’s bond teams change their plans every week when new money numbers come in.

2. War and trade fights.

Bad news can hurt a whole country in one day. Smart teams quickly take money out of shaky places and put more in safe places.

3. Private stuff and big buildings.

Big pension funds love things that pay steady money for many years. IFM looks at world trends and picks the best airports, solar farms, or data centers to buy. These decisions are impossible without proprietary investment research and analytics. Allspring Global Investments – Get Active Campaign & Multi-Asset Solutions2

4. Sustainability and ESG Integration

Today, ignoring climate risk is fiduciary risk. Schroders asked big investors in 2025: Almost 8 out of every 10 said, “We only give money if you show us good green facts first.”

Smart market news shows us which companies and countries are really ready for a clean world with no pollution.

5. Quick wins in normal stocks

Even in stocks you can buy and sell fast, smart teams still win. When the numbers flash a good signal, they buy more of the cheap or best companies. That is how active pros make extra money.

Active vs. Passive: Where Insights Matter Most

| Approach | Best for | Role of Market Insights |

| Passive index investing | Cost-conscious retail investors | Minimal — just follow the index |

| Active professional management | Institutions, pension funds, HNW clients | Central — daily decisions rely on fresh research |

Real-World Examples That Prove the Point

- In 2022 big price jump. Smart teams saw prices going up early. They sold long bonds fast and bought things like oil, gold, and land. The slow teams lost a lot.

- 2023–2025 AI boom: Teams that studied trends bought tech and data-center companies early. They made a lot of money.

- Green energy change: Big pension funds worked with IFM. They bought wind and solar farms years ago. Now they get safe money every year, while others are late.

These wins were not luck. They happened because pros watch the world news and change their plans fast. IFM Investors – Thought Leadership & Infrastructure Insights3

Building a Resilient Multi-Asset Portfolio: Practical Checklist

Professional investors use simple but powerful questions every quarter:

- Are macro trends in investing still supportive of my current equity weighting?

- Do I have enough inflation protection?

- Is my private-asset exposure keeping pace with liability growth?

- Am I truly diversified across geography, sector, and liquidity profile?

- Have new market volatility regimes changed my risk budget?

Answering “yes” to all five is only possible with continuous, high-quality portfolio management insights.

The Growing Role of Technology and Data

Today’s insight engines combine human expertise with massive datasets:

- Satellite imagery tracking retail traffic or crop yields

- Natural-language processing of central-bank statements

- Alternative data on supply-chain stress

Firms that master these tools gain a measurable edge in the investment decision-making process, speed, and accuracy.

FAQs

What are “market insights”?

Fresh news, numbers, and facts about the world economy, companies, and countries. Smart investors use them every day to make better money choices.

Why can’t I just buy a cheap index fund and relax?

Index funds were great before. Now the world changes too fast — index funds go up and down together and miss the new big wins.

Do I really have to change my investments all the time?

Not all the time, but yes, every few months. Small smart changes keep your money safe and help it grow more.

Is this only for giant pension funds?

No! Rich families, normal advisers, and even medium funds all use the same easy steps.

What happens if I ignore market insights?

You can lose a lot when prices jump or rules change. Slow investors lost big money in 2022; fast ones who listened stayed safe.

Do I need to be a genius to do this?

No. Big firms give you the research. You just need to read simple reports and say “yes” or “no” to changes.

Conclusion

Big investors, rich-family helpers, and pro money advisers have one main job: Use good market news and numbers to pick the right places for money.

The world now changes fast, prices jump a lot, and rules surprise us. The winners are the ones who study hard and make smart plans early.

Big companies like Schroders, IFM, and Allspring all say the same thing: Teams that use real market facts build strong money bags that stay safe when things get tough. Teams that guess or go slow lose.