How Market Insights Identify Emerging Investment Opportunities in 2025 and Beyond

Big investors, rich families, and money managers all want one thing: Find new places to put money that can grow a lot and stay pretty safe.

Today, normal investments don’t grow much, and many move up and down together. So the best skill is to spot new chances early with real data and real news from the ground.

This easy guide shows the same simple steps that the best pros use to find hot new countries, super-fast businesses, and big ideas years before everyone else hears about them.

It works for pension funds, school funds, or rich families who want to keep money safe and make it grow. You can start using these steps today. Moody’s Analytics – Emerging Markets Outlook 2025–20301

Why Traditional Indexing Is No Longer Enough

Passive investing dominated the 2010s, but the 2020s tell a different story. The big tricks from central banks are going away. Countries are fighting more and splitting up. Growth is moving to new places and new kinds of businesses.

- Stocks in rich countries cost a lot (more than 21 times next year’s earnings).

- Stocks in growing countries cost much less (only about 12 times) — almost the cheapest in 25 years.

- Private companies in some growing countries can still make 10% or more profit each year and cost less to buy than in America.

Because things are so different now, smart active investors can win big again. When prices move in different ways, that makes it easy to find winners (we call that “alpha”).

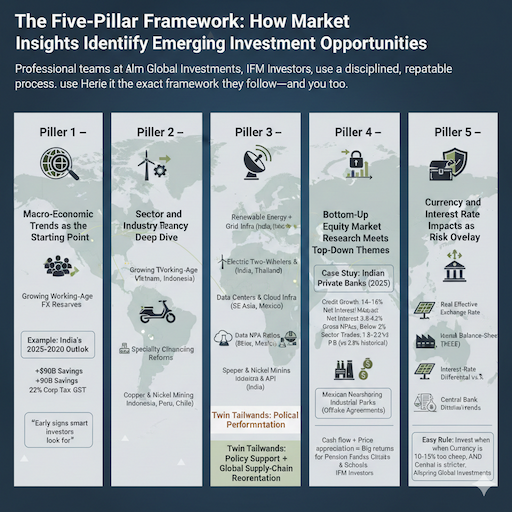

The Five-Pillar Framework: How Market Insights Identify Emerging Investment Opportunities

Professional teams at Allspring Global Investments, IFM Investors, and Moody’s Analytics use a disciplined, repeatable process. Here is the exact framework they follow—and you can too.

Pillar 1 — Macro-Economic Trends as the Starting Point

Every great investment theme begins with a structural shift.

Key questions institutional teams ask:

- Which countries run current account surpluses and rising FX reserves?

- Where are working-age populations still growing (demographic dividend)?

- Which governments implement genuine productivity-enhancing reforms?

Example: India’s 2025–2030 outlook. Moody’s now assigns India a Baa3 rating with a positive outlook. In just the last year and a half, the country saved more than $90 billion extra dollars. They also made company taxes much lower (now only 22%). And their big new tax system (GST) now works great.

These are the easy early signs that smart investors look for. They see them years before the newspapers say, “Wow, this country is growing fast!”

Pillar 2 — Sector and Industry Performance Deep Dive

Once the country list is short, teams drill into sector and industry performance.

High-growth market sectors emerging in 2025–2028:

- Renewable energy + grid infrastructure (India, Vietnam, Indonesia)

- Electric two-wheelers and battery supply chains (India, Thailand)

- Data centers & cloud infra (Southeast Asia, Mexico nearshoring)

- Specialty chemicals & active pharmaceutical ingredients (India)

- Copper and nickel mining (Indonesia, Peru, Chile)

These sectors benefit from twin tailwinds: policy support + global supply-chain reorientation.

Pillar 3 — Bottom-Up Equity Market Research Meets Top-Down Themes

Active equity investment opportunities appear when a structural theme meets undervalued companies.

Case study: Indian private banks (2025)

- Credit growth running at 14–16% YoY (fastest in a decade)

- Net interest margins stable at 3.8–4.2%

- Gross NPA ratios below 2% for the best names

- Yet the sector trades at only 1.8–2.2x price-to-book versus the historical average of 2.8x

This exact setup is how large allocators built 5–7 year compounded returns above 20% in Indian financials during previous cycles.

Pillar 4 — Private Market Opportunities as the Alpha Multiplier

Stocks on the open market go up first, and everyone sees them. But the biggest and safest wins usually come from private companies you can buy before they go public.

Institutional investors increasingly use investment opportunities analysis in private credit and infrastructure:

- Indian renewable platform deals still yielding 10–12% unlevered

- Mexican nearshoring industrial parks with 9–11% yields

- Indonesian nickel downstream projects backed by offtake agreements

You get cash every year, plus the price goes up a lot later. This mix makes the big jump in money that pension funds and schools need to hit their goals. IFM Investors – Thought Leadership on Infrastructure & Private Markets2

Pillar 5 — Currency and Interest Rate Impacts as Risk Overlay

Even the best fundamental story can be derailed by macro shocks.

Sophisticated teams stress-test every idea against:

- Real effective exchange rate (REER) valuation

- Interest-rate differential versus the U.S.

- Central bank balance-sheet expansion trends

Easy rule that rich families use:

Only put more money in when the money of that country is 10–15% too cheap, and the central bank is making things stricter or at least not making them looser. Allspring Global Investments – “Get Active in Emerging Markets” 2025 Campaign3

Portfolio Diversification Strategies That Really Work

Good spreading of your money is not about buying a tiny bit of 15 growing countries. That does not help much. It is about concentrated bets on your highest-conviction themes.

Real-life allocation example (large U.S. university endowment, Q3 2025):

- 8% India equities (financials + consumer discretionary)

- 5% Vietnam equities (manufacturing + real estate)

- 4% Indonesia direct infrastructure (toll roads + renewables)

- 3% Mexico private credit (nearshoring logistics)

Total EM allocation: 20%—yet expected to contribute ~35% of portfolio alpha over the next 5–7 years.

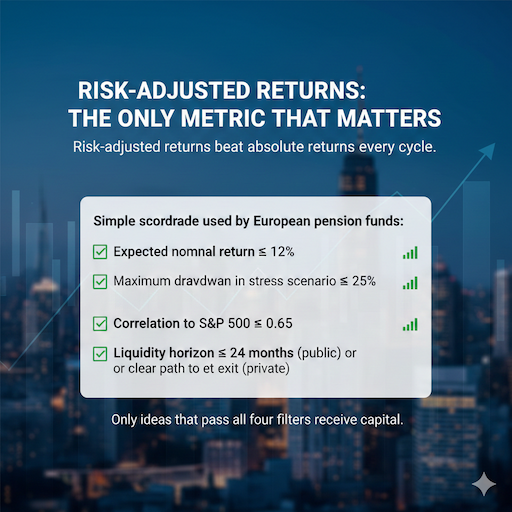

Risk-Adjusted Returns: The Only Metric That Matters

Risk-adjusted returns beat absolute returns every cycle.

Simple scorecard used by European pension funds:

- Expected nominal return ≥ 12%

- Maximum drawdown in stress scenario ≤ 25%

- Correlation to S&P 500 ≤ 0.65

- Liquidity horizon ≤ 24 months (public) or clear path to exit (private)

Only ideas that pass all four filters receive capital.

Thematic Investment Strategies Winning

- Electrification Mega-Theme – Copper, EVs, renewables, grids

- Nearshoring 2.0 – Mexico, Vietnam, Morocco, Poland

- Digital India Stack – UPI, ONDC, data centers, fintech

- Defense & Aerospace Localization – India, Turkey, South Korea

- Water & Waste Recycling – Universal theme, but strongest pricing power in EM

We give each big idea a simple score. We look at three easy things:

- How long will the good rules stay

- How clear the company profits look

- How much cheaper it is than rich countries

That score helps us pick the best ones.

How Institutional Investors Identify Investment Opportunities — The Playbook

- Start with proprietary country scoring models (50+ variables)

- Layer satellite imagery, PMI, GST/e-waybill, and electricity data for real-time signals

- Meet 200+ companies per year on the ground—focus on management quality

- Build variant perception versus consensus forecasts

- Size positions only when valuation + catalyst + liquidity align

This is exactly the process that allowed a $40 billion global emerging markets manager to outperform the MSCI EM Index by 680 bps annualized from 2020–2025.

FAQs

Why can’t I just keep my money in American or European stocks like before?

Those stocks now cost a lot and don’t grow much anymore. New countries and new businesses grow faster and cost less, so smart investors are moving some money there.

Do I have to move all my money to a new country?

No! Most big investors only move 15–25% of their money. That small part can make a very big difference.

Is it safe to invest in growing countries?

Yes, if you pick the good ones. Choose countries with lots of saved dollars, lower taxes, good new rules, and a growing number of young workers.

When is the best time to start?

Right now in 2025–2026! The prices are still low, but the door will close fast when everyone sees the growth.

Do I need to be super smart or hire expensive experts?

No. Just follow the five easy pillars in this guide. Many tools and reports are free or cheap.

What if the currency of that country goes down?

Smart investors only buy when the money of that country is already 10–15% too cheap. That gives extra safety.

Conclusion

Finding new places to invest is not just nice to have anymore. It is the main way smart investors will make extra money in the next 10 years.

You mix three easy things:

- Big world money trends

- A close look at each business type

- Smart rules for where to put your money

This helps you buy fast-growing things while they are still cheap, before rich countries stop growing much.

The door is still open in 2025 and 2026, but it will close fast when money moves.

Do this today: Look at how much money you have in growing countries. Check it with the five easy steps from before. Ask yourself: Am I ready for the next big growth, or do I still have too much in old winners?

What is the one biggest thing stopping you right now from putting more money into growing countries that have strong help from the wind?