How Macroeconomic Trends Affect Market Insights: A Guide for Investors and Strategists

In this fast-money world, big changes can help or hurt your money plans. These big changes are called macro trends.

They are like giant waves in the sea. If you know the waves, you can sail safely and find good places.

Things like how fast a country grows or how much prices go up change stocks and sales every day. Big investors, bankers, and smart bosses watch these waves all the time.

This easy article will show you:

- What macro trends are

- real examples you can see today

- simple ways to use them

You will also see why smart companies like Rosenberg Research look at numbers like GDP and jobs to pick the best roads. No matter if you run a big fund or plan for a company, these easy ideas help you win more and lose less!

Let’s dive in.

What Are Macroeconomic Trends?

What are macroeconomic trends? At their core, they are large-scale patterns in the economy that unfold over months or years. These include shifts in overall growth, prices, jobs, and trade. Unlike daily news, they set the stage for long-term moves in markets.

For example, a rise in global trade barriers can slow growth worldwide. According to the World Bank, growth in East Asia and the Pacific is set to drop to 4.5% in 2025 due to such barriers. This isn’t just numbers—it’s a signal for investors to rethink supply chains and asset picks.

Macro trends matter because they link the big economy to your daily choices. Portfolio managers watch them to balance stocks and bonds. Business leaders use them for pricing products. Even high-net-worth individuals adjust retirement plans based on these shifts.

Key Types of Macroeconomic Trends

Here are the main ones, explained step by step:

- Growth Trends (GDP Shifts): Gross Domestic Product measures a country’s output. Steady GDP growth means more jobs and spending. In 2025, U.S. GDP is projected at 2.0% by EY, down slightly due to tariffs but boosted by AI investments.

- Inflation Patterns: Rising prices cut buying power. Here are 4 big money waves happening right now, told super easily:

- Prices calm down. The world’s prices are dropping fast. In 2026, they will be only 2.9%. That makes bonds and shopping feel happier.

- Jobs are good, but slowing. In America, very few people are without jobs (only 4.3%). That looks strong! But new jobs are growing slowly outside hospitals. This can make stocks a little worried.

- Bank buttons go up and down. Big banks c1hange the cost of borrowing money. Low cost → people borrow and spend more. High cost → stops fast price rises but can hurt stocks.

- Trade fights and country news. New taxes on things coming into America (19.5%) make oil, metals, and money change prices. It shakes the world a little.

- All these waves mix. They can make 2025 feel slower because leaders keep changing the rules. Smart people watch a magic list called “Leading Economic Index” to guess what comes next. It’s like a weather report for money! IMF World Economic Outlook, April 202

How Macroeconomic Trends Affect Market Insights

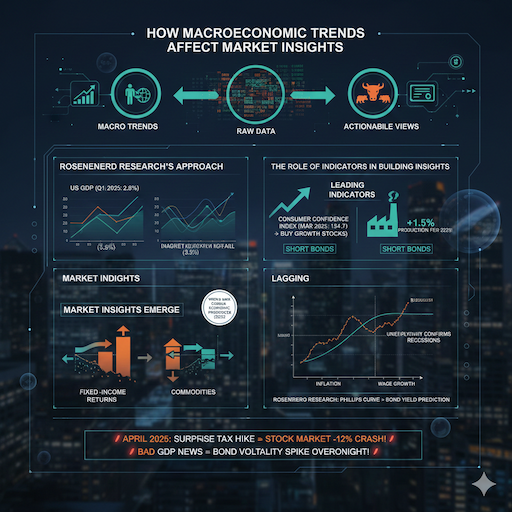

Now, the heart of it: how macroeconomic trends affect market insights. These trends turn raw data into actionable views. They reveal if a bull market lasts or if bonds offer safety. By studying them, you gain foresight—crucial for institutional investors allocating billions.

Take Rosenberg Research’s approach. They blend GDP with employment to predict behaviors. A 2.8% U.S. GDP rise in Q1 2025, paired with 3.5% unemployment, hinted at robust consumer spending. This insight? Boost equities in retail sectors.

Market insights emerge when trends meet data. Macro trend analysis spots patterns, like how inflation erodes fixed-income returns. Investors then hedge with commodities. World Bank Global Economic Prospects (2025)2

The Role of Indicators in Building Insights

Indicators are your toolkit. They split into three types:

- Leading Indicators: Hint at what’s coming. The Consumer Confidence Index (CCI) hit 134.7 in March 2025, signaling spending upticks. Use this to buy growth stocks early.

- Coincident Indicators: Show now. In February 2025, factories made 1.5% more things. This happy number showed the world was feeling strong right then.

Smart people used it to pick the best short bonds and win money fast! - Lagging Indicators: Confirm past moves. Unemployment confirms recessions but helps validate long-term strategies.

Professional investors layer these for depth. For example, the smart people at Rosenberg Research use a magic line called the Phillips Curve. They look at how fast prices go up and how fast workers get more money. This helps them guess what will happen to bonds way better!

In real life, big money news can shake things fast. One day in April 2025, a surprise about new taxes made the stock market drop 12% super quickly! When GDP news is bad, bond prices jump up and down like crazy overnight.

That is why watching the big waves helps you stay safe and win!

Macroeconomic Trends Examples Across Asset Classes

To make it real, let’s explore macroeconomic trends examples. We will see how these big waves hit stocks, bonds, and gold.

Smart people at Macrosynergy looked at many years of numbers. They found: big money waves tell us what will happen in the next few months, not just tomorrow.

They work because people feel brave or scared, and because the money prize changes slowly. It is like knowing the weather for the whole season, not just one hour!

1. Equities: Growth and Inflation at Play

Strong GDP lifts earnings, boosting stocks. But high inflation raises discount rates, hurting valuations.

- Example: In 2025, U.S. equities face headwinds from 1.8% growth slowdown (OECD). But tech and AI places still shine bright like stars! When banks start giving more money to these companies, it is a big happy sign.

Macrosynergy says this sign brings 5–10% extra money wins! - Insight for Investors: Portfolio managers tilt toward cyclicals in expansions. Tip: Use macro uncertainty indices to time entries—low uncertainty favors value stocks.

What are macro trends here? Persistent growth differentials drive equity trends, per Macrosynergy. A 1% GDP gap between economies can yield 3-5% annual outperformance.

2. Fixed Income: Yield Curves and Rates

Bonds react to rate expectations. Stable growth flattens curves; surprises steepen them.

- Example: U.S. 10-year yields rose in 2025 amid tariff fears, explaining 33% of quarterly bond swings (Macrosynergy). Real rates fell since the 1980s due to saving surges from demographics.

- Insight: Analysts watch nowcasted growth for returns. In recessions, duration bets pay off as yields drop.

Macro trends 2025 include de-anchoring inflation, pushing investors to TIPS for hedging.

3. Foreign Exchange (FX): Differentials Drive Dynamics

Growth gaps and external balances move currencies. Strong economies attract flows.

- Super easy examples:

- In early 2025, the US dollar got stronger because America grew faster than others. But Europe will grow very slowly (only 1.0% in 2026), so the euro will get weaker. Macrosynergy says these numbers guess the money fight right almost every time!

- Smart hedge funds play a safe game called “carry trade.” They borrow cheap money and put it where it grows more. When they add the big money waves, they win an extra 4–6% almost every year!

Hedging matters, FX forwards immunize against global shocks.

4. Commodities: Demand Shocks Rule

Industrial demand ties to cycles. Energy and metals follow GDP.

- Example: Base metals futures rose with 2025’s global demand signals, but tariffs curbed gains. Precious metals hedged inflation, with gold ETFs inflows at $8.65 billion (Acuity).

- Insight: Institutional investors aggregate business confidence for predictions. Big cycles last 10+ years from demand shocks.

10 examples of macro trends in commodities? Think oil via shipping costs, or gold as an inflation buffer. Understanding Macroeconomic Trends and Their Sales Impacts3

5. Credit: Default Risks and Stress

Tight conditions widen spreads. Macro default proxies predict low-grade returns negatively.

- Example: Sovereign CDS fell with rising debt ratios in 2025, per Macrosynergy. High stress demands higher yields.

- Insight: Portfolio managers favor investment-grade in uncertainty.

Cross-asset, trends shift correlations—equity-bond links turn positive in monetary regimes.

These macroeconomic trend examples show versatility. For business strategists, they guide expansions; for academics, they fuel models.

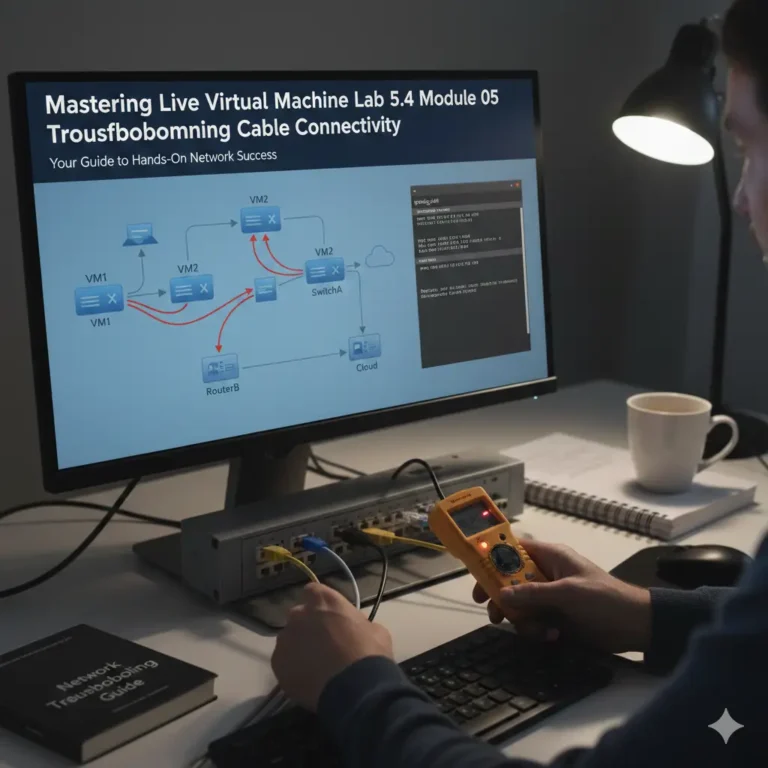

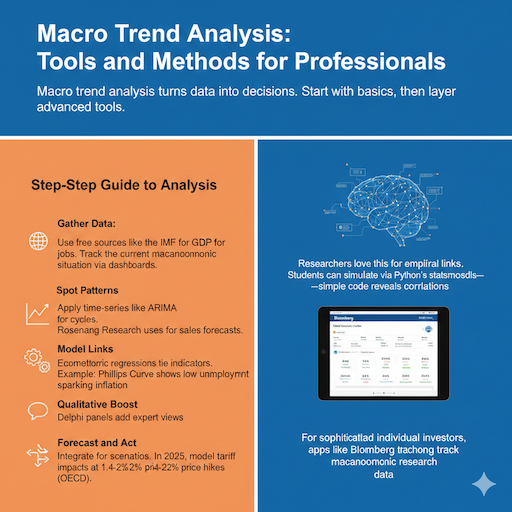

Macro Trend Analysis: Tools and Methods for Professionals

Macro trend analysis turns data into decisions. Start with basics, then layer advanced tools.

Step-by-Step Guide to Analysis

- Gather Data: Use free sources like the IMF for GDP, the BLS for jobs. Track the current macroeconomic situation via dashboards.

- Spot Patterns: Apply time-series like ARIMA for cycles. Rosenberg Research uses this for sales forecasts.

- Model Links: Econometric regressions tie indicators. Example: Phillips Curve shows low unemployment sparking inflation.

- Qualitative Boost: Delphi panels add expert views on policies.

- Forecast and Act: Integrate for scenarios. In 2025, model tariff impacts at 1.4-2.2% price hikes (OECD).

Researchers love this for empirical links. Students can simulate via Python’s statsmodels—simple code reveals correlations.

For sophisticated individual investors, apps like Bloomberg track macroeconomic research and data.

Real-World Application: Rosenberg and Macrosynergy Insights

Rosenberg frames analysis around interconnected puzzles. Their 2025 report highlights global events like trade tensions disrupting autos.

Macrosynergy’s study proves trends’ power: Growth nowcasts explain bond returns; uncertainty spikes volatility.

Easy tip for smart money people:

Make a simple “strength number” every month. Add up three easy things:

- how fast the country grows (GDP)

- How many jobs do we have

- How fast prices go up

A high number = good time for stocks! A low number = be careful, maybe buy safe things.

This little score guesses the next big wave very well!

Implications for Businesses and Sales Strategies

Beyond investing, how macroeconomic trends affect market insights guides operations. Corporations use them for planning; sales professionals for pitches.

From Sistas In Sales: GDP growth boosts spending, but unemployment curbs it. In 2025, with U.S. payrolls at 30,000 monthly (Deloitte), focus on value sales.

Key Impacts on Business

- Inventory and Pricing: High inflation? Raise prices cautiously. Moderate? Stock up on demand risers.

- Expansion Decisions: Low rates favor growth. 2025’s fiscal impulses (EY) signal M&A upticks.

- Risk Management: Strategic managers hedge via derivatives, eyeing exchange-rate dynamics.

Business development pros align with trends. Example made super easy:

Big money changes bring lots of smart robots (AI). These robots now do boring sales jobs like typing and counting. People get more free time to make real friends and help customers smile! (Sistas In Sales says this is happening now.) Macroeconomic Trends and Financial Markets: Theory and Evidence4

What is a macro trend in fashion? It’s like sustainable fabrics rising with green policies—businesses pivot fast.

For retail, macro trends 2025 mean e-commerce surges amid remote work.

Macro Trends 2025: What to Watch

Looking ahead, macro trends 2025 center on uncertainty. Global growth at 2.3% (World Bank), down from forecasts, stems from tariffs and policy shifts.

Top 5 Trends for Investors

- Trade Barriers: 60% China tariffs could add 1.4% to prices (OECD). Impact: Commodities are volatile; favor diversified FX.

- Demographic Shifts: Aging populations slow labor growth to 1% (Kenan Institute). Insight: Boost healthcare equities.

- AI and Tech Boom: Investments sustain 2% U.S. growth (EY). Stocks in semis up 15-20%.

- Inflation Moderation: To 2.9% globally. Bonds gain; credit tightens.

- Geopolitical Flows: Immigration curbs hit GDP by 0.5% (Deloitte). EM opportunities in India are rising.

Major macro trends like these reshape portfolios. High-net-worth individuals add gold for hedges.

For academics, study via PESTLE: Political tariffs, economic slowdowns, etc.

How Macroeconomic Trends Affect Market Insights in Portfolio Management

Back to the focus: How macroeconomic trends affect market insights shines in allocation. Institutional investors use them for diversification.

Multi-asset correlations flip with regimes—fiscal shocks negative for equity-bond (Macrosynergy).

Actionable Strategies

- Asset Allocation: 60/40 portfolios adjust: More equities in growth phases.

- Risk Hedging: Use FX for global buffers.

- Timing: Enter on leading signals as CCI rises.

Analysts in training model this: Regress returns on GDP surprises for edges.

What Are Micro Trends?

What are micro trends? Short-lived fads, like viral TikTok styles, vs. macro’s deep shifts. Micros ride macros, e.g., EV hype on green trends.

For investors, blend both: Macros for direction, micros for entries. How Macroeconomic Analysts Predict Market Trends5

Real Wins from Trend Insights

- 2025 Tariff Shock: S&P dropped 12%, but gold rose 10%. Early macro watchers hedged wins.

- Post-Pandemic Recovery: Employment rebounds lifted retail stocks 20% (Rosenberg data).

These show macro trend analysis pays

FAQs

What are big money trends?

They are the big, slow changes in money and the world. Like how fast countries get bigger (GDP). Or how much things cost more (inflation). Or how many people have jobs. These changes move stocks, bonds, and all things for many months or years.

How do big money trends help us know about markets?

They show the big picture. So you can guess what comes next. When you know the changes, you spot which stocks or bonds will go up or down first.

What are some big money trend examples for 2025?

The world is growing slowly (just 2.3%). New taxes on stuff from other lands are going up. And smart robots (AI) make work fast and cheaply. These three big things change money each day this year.

How can shops use big trend checks?

Shops look at the big changes to plan well. Like, make more toys if GDP says people get more money. Or buy less if costs go up fast. It helps them stay safe and sell more.

Why look at big trends in 2025 for putting money in things?

2025 has many surprises and changes. So watching big changes helps you pick the good ones (like tech and some growing lands). And skip the bad ones.

It’s like a map in a big storm!

Conclusion

We’ve explored how macroeconomic trends affect market insights, from definitions to 2025 forecasts. Key takeaways: Track indicators like GDP and inflation for edges in equities, bonds, and beyond. Institutional & professional investors, portfolio managers, and analysts thrive by integrating these—whether hedging FX or planning sales. Businesses gain from aligned strategies, while researchers and students find rich theory in works like Macrosynergy’s.

In sum, macro trends aren’t abstract; they’re your roadmap to informed moves. Stay vigilant, blend data with models, and adapt.