Is There A 30-Day Grace Period For Health Insurance: Key Facts You Need

Many people ask Is There A 30-Day Grace Period For Health Insurance when they face a late bill. This time lets you pay after the due date without quick loss of care. In places like the US and Canada, rules change by plan type and state1. For most, yes, a 30-day window exists to catch up. But for some with help on costs, it stretches longer. This can save you from gaps in care. Folks in Tier 1 spots often search this to stay safe. We share clear facts from top sources. You get what it means and how to use it. No stress if you know the steps. Read on for easy tips to keep your plan strong.

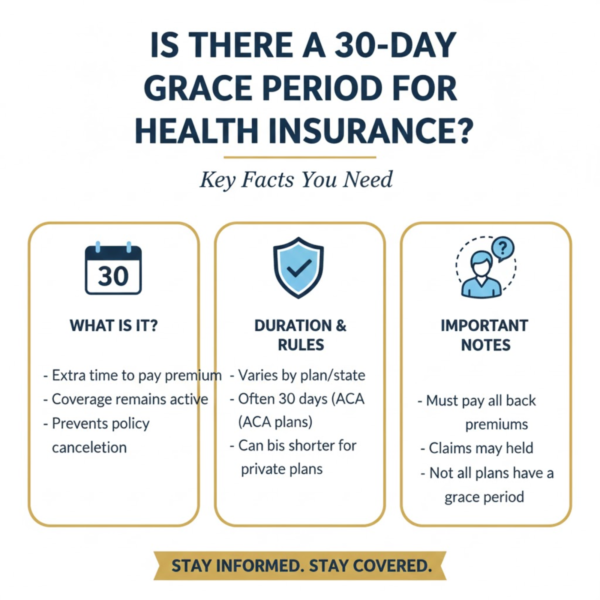

What Is a Health Insurance Grace Period?

A health insurance grace period gives extra days to pay your bill after it’s due. It stops your plan from ending right away. In the US, most plans give at least 30 days2. This comes from state laws for plans without cost help. If you get aid like tax credits, it jumps to 90 days under ACA rules. But watch out. In that long window, care might stop after the first 30 days if not paid. Claims get denied till you catch up. For group plans from jobs, it’s often 30 days too. In Canada, it varies by province but hovers around 30 days for many. This buffer helps if cash is tight. Stats show 20 percent of folks use it once a year per survey. It keeps care going. But pay fast to avoid issues. Know your plan’s exact time. Check your papers or call your firm. This stops surprises.The grace period starts the day after your bill is due. Say due on the first, grace runs to the month end. If you pay in time, no break in care. Miss it, and your plan may end back to the last paid month. This means you owe for doc visits in between. For folks with ongoing health needs, this matters big. It ties to insurance premium payment rules. Always set auto pay if you can. Or alerts on your phone. This makes life easy. Many say it saves stress. Tie to your budget. Plan ahead for bills.

Is There A 30-Day Grace Period For Health Insurance in Most Plans?

Yes, Is There A 30-Day Grace Period For Health Insurance in many cases. For plans without aid, states set it at 30 or 31 days. Like in Texas or New York. This lets you pay late but keep care. For ACA plans with help, it’s 90 days if you paid at least one bill that year. But here’s the key. In those 90 days, your firm pays claims only for the first 30. After that, they hold till you pay all. If not, the plan ends back to month one. You repay aid too on taxes. About 15 percent of ACA folks face this per reports. In other lands like India, it’s 15 to 30 days by firm. For you in Tier 1, check local rules. Call your plan or see online. This answer Is There A 30-Day Grace Period For Health Insurance clear. It varies but often yes. Use it wise. Don’t wait until the last day. Mail or online pay early. This keeps peace.For job plans, FMLA says 30 days if on leave. COBRA too often 30. Federal and state grace period rules mix here. State wins for most. Know yours. It helps avoid policy lapse due to non-payment.

What Happens During the Grace Period?

In the health insurance grace period, your care stays on if you pay by end. You can see docs and file claims. But for long 90-day ones with aid, after 30 days, firms may not pay new claims till you catch up. Old ones from the first 30 ok. This is coverage during the grace period. It gives breathing room. Say you miss one bill. Use the time to pay. No gap. But if sick, don’t wait. Pay quick to claim. Many firms send reminders. Texts or mail. Sign up for them. This helps. Stats say 80 percent pay in grace with alerts. It ties to the health insurance payment deadline. Set a budget for it. Or extra funds. Reassure you. Care stays. For families, this matters. Kids need steady doc visits.Watch for fees. Some add late charges. Small like 5 percent. But not all. Check your plan. This is part of the premium due date extension.

Consequences If You Miss the Grace Period

If you skip pay past the health insurance grace period, your plan ends. Often back to last paid month. You lose care. Owe for bills in between. Can’t claim. For ACA, repay aid on taxes. Hard hit. About 10 percent lapse each year per data. Then to get back, wait for open sign up. Or life changes like job loss. The new plan starts fresh. Wait times for old ills reset. Lose bonuses like no claim cuts. This is a missed premium consequence. Bad for ongoing care. Like meds or check ups. What happens if I miss a premium payment? Call the firm fast. Some restart if they pay all plus fee. But not always. Tips say talk before the end. They may help. This stops insurance plan cancellation policies. Plan ahead. Auto pay is best.For renewal, miss grace means no auto roll. Start new. Higher cost maybe.

Differences in Grace Periods by Plan Type

Grace times change by plan. No aid, one 30 days state rule. With aid 90 days fed law. But claims hold after 30. Group job plans 30 days often. Short term or gap plans shorter like 10 days. COBRA 30 or more. COBRA and grace period differences here. Monthly bills get grace each time. Year ones once a year. Monthly vs annual premium payment grace matters. Pick what fits your cash flow. For self pay, shorter grace. Check firm. This helps pick right. Many switch for longer grace. Ties to health plan grace rules.

Tips to Avoid Policy Lapse and Use Grace Wisely

Set auto pay from the bank. No mistake. Or an app reminds me. Pay early if you can. Know your due. Mark calendar. If tight, call a firm. They may split or wait. This avoids reinstating insurance after lapse. Save papers. Know your grace. For ACA, pay the first month full to get 90 days. Good tip. Budget for health first. Cut other costs. This keeps insurance coverage continuation. Many say it saves worry. Use online portals. Pay fast. No mail wait.More tips:

- Check mail: Bills come.

- Sign alerts: Email text.

- Budget app: Track due.

- Call help: Ask grace.

- Switch if short: Longer one.

- Save extra: For late.

- Renew early: No lapse.This reassures. Stay covered easily.

State and Federal Rules on Grace Periods

Fed law for ACA gives 90 days with aid. But states set for others. Like California 30 days. Texas is the same. Some 45. Federal vs private health insurance grace period differences. Private follow state. Fed over rides for ACA. Check your state site. Or call. This answers Is There A 30-Day Grace Period For Health Insurance. Often yes. But confirm. For 2025, no big change from search. Steady rules.

FAQs About Is There A 30-Day Grace Period For Health Insurance

Is There A 30-Day Grace Period For Health Insurance Premiums?

Yes, many plans have a 30-day grace period for health insurance premiums. It lets you pay late without a quick end. For no aid plans, it’s standard. With aid, first 30 full care then hold. States set exact. Check yours. This helps if the bill slips. Pay fast to claim. Many use it safely.

What happens if I miss my health insurance payment by 30 days?

If you miss by 30 days, your plan may end. What happens if I miss my health insurance payment by 30 days back to the last payment? Owe bills. For aid, longer grace but claims denied after 30. Repay help. Call the firm quickly. Some let me fix it. Avoid by auto pay. Stay safe.

How long is the grace period for health insurance coverage?

The grace is often 30 days for no aid. 90 for aid. How long the grace period for health insurance coverage varies by state firm. Group 30. Check papers. Care stays if pay ends. Miss reset waits. Tips call ask. Know yours.

What are health insurance grace period rules for monthly payments?

For monthly bills, grace each time. Health insurance grace period rules for monthly payments are 30 days no aid. 90 aid. Pay all to keep. Miss end plan. Set auto. Reminds me of help. Safe way.

Can I reinstate my health insurance after a 30-day grace period?

Sometimes yes if I pay all the fees. Can I reinstate my health insurance after a 30-day grace period but not always. For ACA wait open. Or life changes. Call fast. Better pay in time. Avoid lapse.

What are insurance plan lapse consequences after 30 days?

Lapse means no care. Owe bills. Insurance plan lapse consequences after 30 days reset waits. Lose bonuses. Higher new cost. It’s hard to get back. Pay early best. Tips budget.

What are health insurance premium payment deadlines explained?

Deadlines due in the first month. Grace after. Health insurance premium payment deadlines explained the 30 days buffer. Pay end keep. Missed. Auto pay is easy. Know rules.

Conclusion

Yes, often Is There A 30-Day Grace Period For Health Insurance to pay late. It keeps you awake if you catch up. But it varies by plan state. For aid 90 days claims are held after 30. Miss leads lapse and owe bills. Set auto pay reminders. Call if issue. Stay covered easily. What step will you take first?

References

- For US ACA details, see What happens if I don’t make my premium payment by the end of the grace period?. This helps policyholders in the US understand subsidized vs non lapses. ↩︎

- What is the Grace Period in Health Insurance Plans? ↩︎