Fannie Mae Form 1007 Single-Family Comparable Rent Schedule Guidance: Complete 2025 Guide for Appraisers, Lenders & Investors

You want to buy or change a loan on a house you will rent out. You want to use the rent money to help get the loan. The bank says: A special house checker (an appraiser) must fill out Form 1007.

This paper looks at other similar houses that people rent. It shows how much money your house can really make right now. Form 1007 tells the bank: “Yes, this rent number is real and fair. It is not just a dream number.” That makes the bank feel safe and happy to give you the loan!

This number directly affects how much loan you can get when you use rental income to qualify.

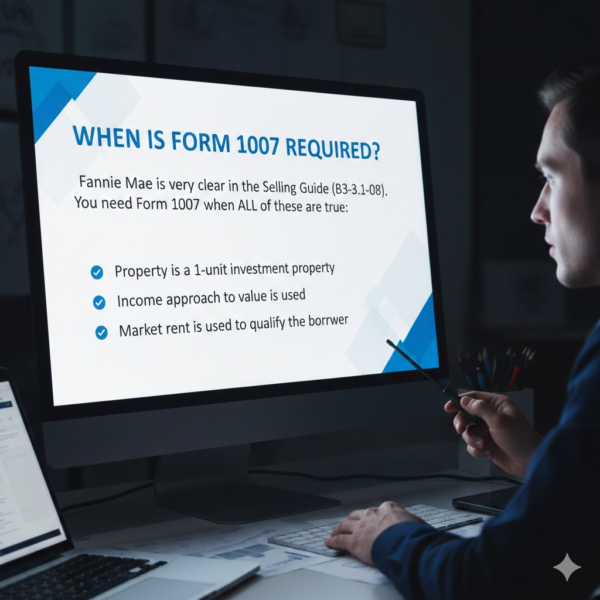

When Is Form 1007 Required?

Fannie Mae is very clear in the Selling Guide (B3-3.1-08). You need Form 1007 when ALL of these are true:

- The property is a 1-unit investment property (not owner-occupied, not 2-4 units)

- The borrower wants to use the future/projected rental income from this property to qualify

- The loan is a conventional mortgage sold to Fannie Mae

Different houses have different papers.

- If you live in the house yourself, or

- If the house has 2–4 homes in it, you use other forms (Form 1000 or Schedule E).

Special tip for bank workers: Even if the person already has a renter and a signed paper, the bank still wants Form 1007 done by an appraiser. Just the signed rental paper is not enough. You need Form 1007, too! rental income rules1

How Appraisers Complete Form 1007 – Step-by-Step Guidance

Appraisers follow a clear process. Here is exactly what they do (and what you should expect to see).

Step 1: Find 3–6 Recent Rental Comparables

Appraisers look for rental comps that are:

- Same property type (single-family house, townhouse, or condo)

- Same general location (usually within 1 mile, always in the same school district or neighborhood)

- Similar size (± 300 sq ft and ± 1 bedroom/bathroom)

- Leased within the last 6–12 months (the more recent, the better)

- Currently listed for rent is acceptable, but leased is stronger

Common mistake to avoid: Using apartments or duplex units as comps for a single-family house. Fannie Mae says “no” – they must be comparable in property type.

Step 2: Fill Out the Grid – Line by Line

The form has columns for the subject property and three rental comparables. Here’s what goes in each line:

| Line | Item | What Appraisers Write |

| 1 | Address | Full address of each comp |

| 2 | Proximity to Subject | Distance in miles |

| 3 | Monthly Rent | Actual or Gross Monthly Rent (including utilities if paid by landlord) |

| 4 | Data Source | MLS, lease agreement, property manager interview, etc. |

| 5 | Rent Concessions | “One month free” or “$500 gift card” – very important to note |

| 6 | Date of Lease | Month/year the lease was signed |

| 7 | Location | Urban / Suburban / Rural – adjust if different |

| 8 | Leasehold/Fee Simple | Almost always Fee Simple for houses |

| 9 | Site | Lot size – adjust if very different |

| 10 | View | Adjust for golf courses, water, busy streets, etc. |

| 11 | Design & Appeal | Ranch vs 2-story, modern vs dated |

| 12 | Age | Effective age after renovations |

| 13 | Condition | Excellent, Average, Fair |

| 14 | Above Grade Room Count | Bed / Bath / Total rooms |

| 15 | Gross Living Area (GLA) | Heated square footage |

| 16 | Basement & Finished Rooms | If the basement is finished, note how many rooms |

| Garage/Carport | 2-car attached vs none – big adjustment | |

| Porch/Patio/Deck/Pool | Covered porch, pool, fence – all get adjustments | |

| Fireplace(s) | Number of fireplaces | |

| Utilities Included | Heat, water, electric – very common adjustment | |

| Other | Gym, storage unit, appliances, etc. |

Step 3: Make Dollar Adjustments

Appraisers give a dollar amount (positive or negative for every difference. Example:

- Comp has 1 extra bedroom → −$150/month to the subject

- Subject has a 2-car garage, comp has none → +$100/month to the subject

- Comp gives one month free rent → −$125/month effective rent reduction

The adjusted rent of each comp should now be very close to each other.

Step 4: Arrive at the Final Estimated Market Rent

The appraiser puts the final number in the box at the bottom: “Estimated Market Rent: $________ per month”

Most appraisers take the median or average of the adjusted comps and round to the nearest $25 or $50. Understanding Form 1007 – A Key Step in Financing Investment Properties2 (2025).

Fannie Mae Form 1007 Single-Family Comparable Rent Schedule Guidance – What Lenders Look For

Underwriters do not re-appraise the rent. They simply check:

- Is the form signed by a licensed/certified appraiser?

- Are at least 3 rental comparables used?

- Are comparables within a reasonable distance and similar?

- Are the adjustments explained and reasonable?

- Is the final market rent supported by the adjusted comps?

If yes → rental income can be used (usually 75% of the Form 1007 number).

Most Common Reasons Form 1007 Gets Kicked Back in Underwriting

- Only 2 comps (Fannie wants 3 minimum)

- Comps older than 12 months with no explanation

- Huge adjustments (±$400+) without strong support

- Using apartment rents for a single-family house

- Forgetting to adjust for concessions (“1 month free” is common)

- Appraiser leaves the final rent box blank

Fixing these saves days or weeks in closing. Form 1007 paper

How Investors Can Help Get a Strong Form 1007

- Give your appraiser a list of recent leases in the neighborhood (addresses + rent amounts)

- Provide photos of upgrades (new kitchen, flooring, paint) – helps justify higher rent

- Make sure the house is clean and staged when the appraiser visits

- If you are already under contract with a tenant, give the appraiser a copy of the signed lease early

The better data the appraiser has, the stronger (and usually higher) the market rent will be.

Form 1007 vs Form 216 – Quick Comparison

| Feature | Form 1007 | Form 216 (Operating Income Statement) |

| Used for | 1-unit investment properties | 2–4 unit properties |

| Completed by | Appraiser only | Can be an appraiser or lender |

| Focus | Market rent only | Income + expenses |

| Required when | Using projected rent to qualify | Almost always for 2-4 units |

FAQs

Can a real estate agent complete Form 1007?

No. Only a licensed or certified appraiser may complete it for Fannie Mae loans.

Does a signed lease replace Form 1007?

No. Fannie Mae still requires the appraiser’s market analysis in almost every case.

What if there are no good rental comps?

The appraiser must expand the search area and explain why (rural area, new construction, etc.). The underwriter decides if it’s acceptable.

How much can the rent on the lease be above Form 1007?

Fannie Mae allows the lease amount to be up to 115% of the Form 1007 number with no further explanation. Above 115% needs strong support.

Conclusion

Form 1007 is a special paper that helps you rent out a house and still get a big loan. It shows how much money the house can make from rent.

When the appraiser does this paperwork the right way, the bank feels happy and safe. Then you get your loan faster, and you can borrow more money3!

If you check houses, work at a bank, or buy houses to rent, knowing Form 1007 very well helps you win big today!

References

- Read about rental income rules from Fannie Mae. ↩︎

- Check this blog: Understanding Form 1007 – A Key Step in Financing Investment Properties (2025). ↩︎

- See the Form 1007 paper (it’s a PDF). ↩︎