Wells Fargo’s $1.95T Asset Cap Lifted After Meeting Regulatory Requirements – What It Really Means

On June 3, 2025, the Federal Reserve officially announced that Wells Fargo’s $1.95 trillion asset cap had been lifted after meeting regulatory requirements. This decision ends one of the longest and most punishing restrictions ever placed on a major U.S. bank. For investors, bankers, and customers alike, this is big news.

The asset cap, first imposed in February 2018, froze Wells Fargo’s total assets at roughly $1.95 trillion. The bank could not grow bigger until it proved it had fixed deep problems in risk management, governance, and customer protection after the fake-accounts scandal.

Seven years later, the Fed says Wells Fargo has done enough. The cap is gone.

Why Shares Jumped the Moment the News Broke

Wells Fargo stock rose more than 6% in early trading the day after the announcement. Why? Because removing the cap removes a giant cloud that has hung over the bank since 2018.

As Keefe, Bruyette & Woods analyst David Konrad said,

“This is the final major regulatory overhang being removed. It significantly improves Wells Fargo’s ability to grow the balance sheet organically and through acquisitions.” Full report1

In simple terms, the bank can now compete again, fully, in credit cards, wealth management, commercial banking, and beyond.

What Is an Asset Cap?

An asset cap is a limit that the Federal Reserve puts on a bank’s total assets. It stops the bank from getting any larger until it fixes serious problems. Read here2

- Wells Fargo asset cap 2018: Imposed after employees opened millions of fake accounts without customer permission.

- Federal Reserve asset cap Wells Fargo: One of the strictest punishments ever given to a “systemically important” bank.

- What is an asset cap for a bank? It is like putting a speed limiter on a race car until the driver proves they can drive safely.

Timeline: From Scandal to Freedom

| Year | Event |

| 2016 | Fake-account scandal explodes publicly |

| 2018 | When was the Wells Fargo asset cap imposed? → February 2018 ($1.95T cap) |

| 2018–2024 | Multiple CEOs, billions in fines, 10+ consent orders, massive overhaul |

| 2025 | Wells Fargo asset cap removed – Fed says reforms are “substantially complete.” |

How Wells Fargo Finally Met the Fed’s Demands

The Federal Reserve didn’t lift the cap just because time passed. The bank had to show real, lasting change in three big areas:

- Risk-management enhancements – New systems to spot and stop bad behavior fast.

- Customer-accountability reforms – Stronger protection so fake accounts can never happen again.

- Post-scandal corporate governance – New board members, better checks and balances, clearer separation between sales goals and customer needs.

Fed Governor Michael Barr said the bank made “substantial progress” across all consent orders.

What Happens Next? Growth Is Back on the Menu

With the Wells Fargo growth restrictions lifted, expect the bank to move fast in these areas:

- Credit cards: Wells Fargo had pulled back. Now it can chase market share again.

- Wealth management: The bank wants to grow its high-margin advisory business.

- Commercial banking: Middle-market and large corporate lending can expand.

- Possible acquisitions: The bank now has the green light to buy fintechs or regional players.

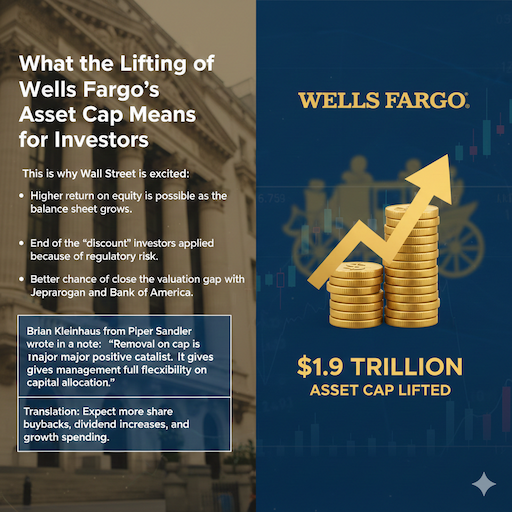

What the Lifting of Wells Fargo’s Asset Cap Means for Investors

This is why Wall Street is excited:

- Higher return on equity is possible as the balance sheet grows.

- End of the “discount” investors applied because of regulatory risk.

- Better chance to close the valuation gap with JPMorgan and Bank of America.

Brian Kleinhaus from Piper Sandler wrote in a note:

“Removal of the cap is a major positive catalyst. It gives management full flexibility on capital allocation.”

Translation: Expect more share buybacks, dividend increases, and growth spending.

For Banking Professionals: A Case Study in Regulatory Remediation

Other large banks are watching closely. Wells Fargo just showed the roadmap for getting out from under tough Fed orders:

- Hire thousands of risk and compliance staff.

- Spend billions on new technology and controls.

- Replace most of the board and senior leadership.

- Accept public criticism and still keep rebuilding.

This is now the textbook example of regulatory remediation programs done right.

For Wells Fargo Customers: Will You See Changes?

Yes, over time.

- More credit card offers and rewards.

- Expanded wealth-management services for everyday millionaires.

- Bigger commercial lending teams that can approve larger loans faster.

The bank says it will stay focused on “doing right by customers,” but growth will bring new products and competition.

The Bigger Picture: Trust Rebuilt?

The sales-practice scandal resolution took almost a decade and cost Wells Fargo more than $4 billion in fines plus untold billions in lost growth.

The Fed lifting the cap is the strongest signal yet that regulators believe the bank has truly changed.

FAQs

What was the Wells Fargo asset cap?

It was a big rule from the Federal Reserve that said, “You cannot grow bigger than $1.95 trillion.” The bank got stuck at that size for seven whole years because of the fake accounts mess.

Why did they get the cap in the first place?

Employees opened millions of accounts without customers saying “yes.” That was super wrong, so the government said, “Fix everything before you get to grow again!”

When exactly was the cap taken away?

On June 3, 2025, the Federal Reserve said, “Good job fixing things — you’re free now!”

Why did the stock price jump right away?

Investors were so happy! The big dark cloud is gone, so the bank can finally grow big and make more money again. Shares went up more than 6% the next day — everyone was cheering!

What can Wells Fargo do now that it couldn’t do before?

Grow bigger! Launch new credit cards, get richer customers, lend to more businesses, and even buy other companies if they want.

Will customers notice anything different?

Yes, and it will be good! You’ll start seeing more credit card offers, better rewards, richer banking services, and faster big loans for businesses.

Conclusion

The announcement that Wells Fargo’s $1.95t asset cap lifted after meeting regulatory requirements marks the end of a dark chapter and the start of a new growth era for America’s third-largest bank by assets. Read the full article3

Investors see higher profits ahead. Banking professionals see a model for fixing broken cultures. Customers can expect more choices.

After seven long years, Wells Fargo is finally free to grow again.’

References

- CEF Connect – “Wells Fargo poised to escape Fed cap” → Full report ↩︎

- Yahoo Finance – “Wells Fargo nears end of $1.95 trillion asset cap” → Read here ↩︎

- Reuters (June 3, 2025) – “Fed lifts Wells Fargo’s asset cap, citing progress on sales scandal” → Read full article ↩︎